Compliance Officers: Intelligent Regulatory Management

Strengthen regulatory compliance and risk management with AI-powered contract analysis that identifies compliance gaps, regulatory risks, and policy violations across massive contract portfolios.

The Modern Compliance Challenge

Compliance officers operate in an increasingly complex regulatory environment where the consequences of oversight can include substantial financial penalties, reputational damage, operational restrictions, and personal liability. The challenge is compounded by the vast number of contracts that organizations execute across multiple jurisdictions, business units, and regulatory frameworks, each potentially containing provisions that could create compliance obligations or risks.

Traditional approaches to compliance monitoring rely heavily on periodic audits, spot-checking, and reactive investigation following incidents or regulatory inquiries. These methods are inherently limited in their ability to provide comprehensive oversight of dynamic contract portfolios where new agreements are constantly being executed and existing contracts may be amended or renewed with changing terms.

The volume and complexity of modern regulatory requirements make comprehensive manual compliance monitoring practically impossible for most organizations. Regulations span multiple domains including financial services, healthcare, data privacy, environmental protection, employment law, and industry-specific requirements that may overlap and interact in complex ways that are difficult to track and manage manually.

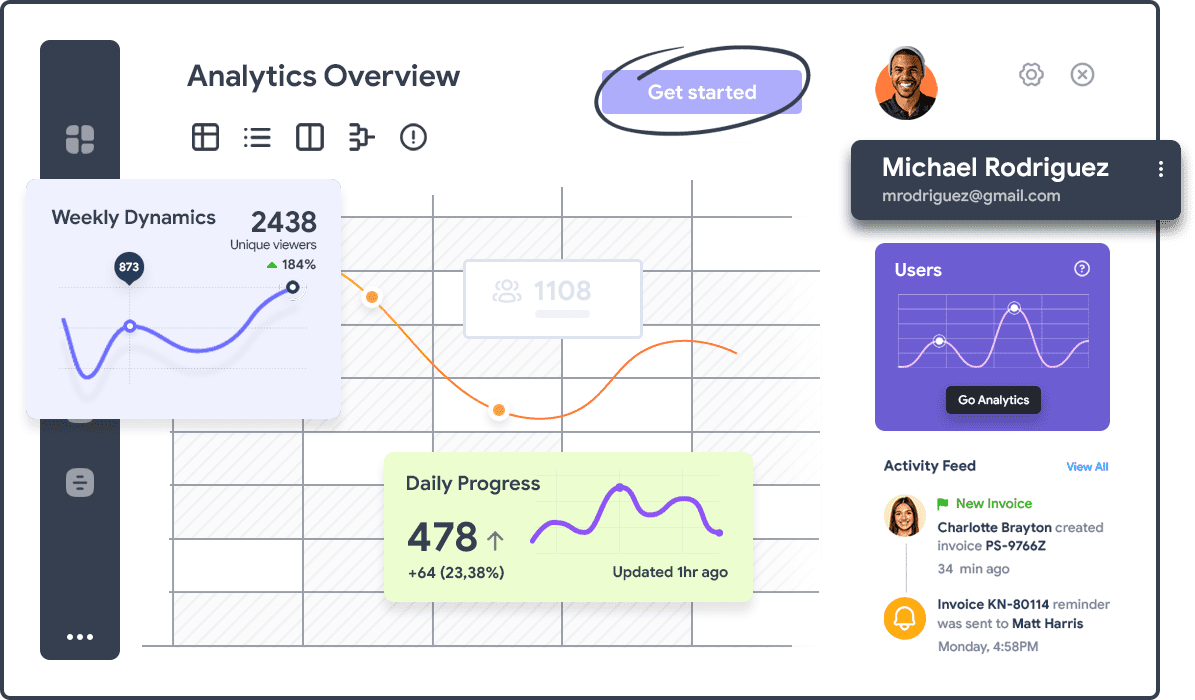

AI-powered contract analysis transforms compliance management from a reactive, resource-intensive process to a proactive, intelligent system that continuously monitors contract portfolios for compliance issues and provides early warning of potential problems. This technological advancement enables compliance officers to manage larger portfolios more effectively while reducing risk exposure and improving regulatory relationships.

Continuous Compliance Monitoring

The shift from periodic compliance audits to continuous monitoring represents a fundamental improvement in risk management capability. AI-powered systems can monitor contract portfolios continuously, identifying compliance issues as they arise rather than waiting for scheduled reviews or incident-driven investigations. This proactive approach enables early intervention and prevention rather than reactive damage control.

Real-Time Regulatory Analysis

AI systems can be configured to monitor contracts against specific regulatory requirements, automatically flagging provisions that may create compliance obligations or risks. This analysis can be updated as regulations change, ensuring that compliance monitoring evolves with the regulatory environment rather than relying on static checklists that may become outdated.

The technology can simultaneously monitor multiple regulatory frameworks, identifying potential conflicts or overlapping requirements that could create complex compliance challenges. This comprehensive analysis is particularly valuable for organizations operating across multiple jurisdictions or industry sectors with different regulatory requirements.

Policy Compliance Verification

Beyond regulatory compliance, AI analysis can verify adherence to internal policies, governance standards, and corporate guidelines that organizations use to manage risk and ensure consistent operations. This internal compliance monitoring helps prevent policy violations that could create operational issues or regulatory exposure.

The system can be customized to reflect organization-specific requirements, escalation procedures, and approval processes, ensuring that all contracts comply with internal controls and governance frameworks. This customization enables compliance officers to enforce corporate standards while adapting to business needs and operational requirements.

Exception Reporting and Escalation

AI systems provide automated exception reporting that highlights contracts or provisions requiring immediate attention, enabling compliance officers to focus their efforts on truly problematic issues rather than conducting comprehensive reviews of routine agreements. This exception-based approach improves efficiency while ensuring that high-risk situations receive appropriate attention.

Advanced Risk Assessment and Mitigation

Effective compliance management requires sophisticated risk assessment capabilities that can identify not only obvious compliance violations but also subtle risks that could develop into significant problems over time. AI-powered analysis provides comprehensive risk intelligence that enables proactive mitigation strategies and informed decision-making about risk tolerance and management approaches.

Multi-Dimensional Risk Analysis

AI systems analyze contracts across multiple risk dimensions simultaneously, including regulatory compliance, financial exposure, operational impact, and reputational risks. This comprehensive analysis provides a complete risk profile that enables better decision-making about risk acceptance, mitigation strategies, and resource allocation priorities.

The technology can also identify risk concentrations and correlations across contract portfolios, highlighting situations where multiple contracts might create cumulative risks that exceed acceptable tolerance levels. This portfolio-level analysis is difficult to achieve through traditional contract-by-contract review approaches.

Predictive Risk Modeling

Advanced AI systems can identify patterns and trends in contract terms that may indicate emerging risks or changing business practices that could impact compliance requirements. This predictive capability enables proactive policy development and risk mitigation before problems become entrenched or widespread.

Predictive analysis can also identify contracts that may require attention due to changing regulatory requirements or business conditions, enabling compliance officers to prioritize review and remediation efforts based on risk levels and business impact rather than arbitrary schedules or reactive triggers.

Regulatory Change Impact Assessment

When new regulations are enacted or existing requirements are modified, AI systems can quickly analyze contract portfolios to identify agreements that may be affected, enabling rapid assessment of compliance implications and necessary remediation actions. This capability is particularly valuable in rapidly evolving regulatory environments where quick response times are critical for maintaining compliance.

Enhanced Audit and Reporting Capabilities

Regulatory audits and examinations require comprehensive documentation and evidence of compliance efforts, risk management practices, and remediation actions. AI-powered contract analysis provides detailed documentation and analytical capabilities that significantly enhance audit preparation and response capabilities while reducing the time and resources required for audit compliance.

Comprehensive Documentation

AI systems automatically generate detailed documentation of contract analysis, compliance verification, risk assessment, and remediation actions that provides auditors with comprehensive evidence of compliance efforts and risk management practices. This documentation is typically more detailed and consistent than manual compliance records.

The automated documentation also provides clear audit trails that demonstrate compliance monitoring processes, decision-making rationales, and corrective actions taken to address identified issues. This transparency is particularly valuable during regulatory examinations where demonstrating effective compliance programs can impact regulatory assessment and potential enforcement actions.

Data Analytics and Reporting

AI analysis generates comprehensive data about compliance performance, risk trends, and policy effectiveness that can be used to demonstrate compliance program effectiveness and support regulatory reporting requirements. This data-driven approach to compliance reporting provides more sophisticated insights than traditional narrative reports.

Advanced analytics can also identify areas for compliance program improvement, resource allocation optimization, and risk management enhancement that demonstrate continuous improvement efforts and proactive compliance management approaches that regulators typically view favorably.

Rapid Response Capabilities

When regulators request specific information or documentation during examinations or investigations, AI systems can quickly search contract portfolios and generate responsive materials that would require significant manual effort to compile. This rapid response capability can significantly reduce the burden and cost of regulatory compliance while demonstrating organizational competence and cooperation.

Strategic Compliance Leadership

The ultimate goal of compliance transformation is to elevate the compliance function from reactive problem-solving to strategic risk management that supports business objectives while maintaining appropriate regulatory protection. AI-powered contract analysis provides the foundation for this transformation by enabling proactive risk management and strategic guidance that adds measurable value to organizational operations.

Proactive Policy Development

Comprehensive contract analysis provides valuable intelligence for developing and refining compliance policies, risk management frameworks, and governance standards. Understanding how contractual provisions interact with regulatory requirements enables more effective policy development that balances compliance protection with business operational needs.

The insights generated from portfolio analysis can also identify emerging trends, best practices, and effective risk management approaches that can be incorporated into organizational policies and procedures. This continuous improvement approach ensures that compliance frameworks evolve with business needs and regulatory environments.

Cross-Functional Collaboration

AI-powered compliance analysis improves collaboration between compliance officers and other business functions by providing clear, actionable insights that support business decision-making rather than simply identifying problems. This collaborative approach helps integrate compliance considerations into business processes rather than treating compliance as an external constraint.

Enhanced collaboration is particularly valuable for complex business initiatives where compliance requirements may impact strategic planning, operational design, or commercial arrangements. Compliance officers can provide proactive guidance that enables business success while maintaining appropriate risk protection.

Regulatory Relationship Management

Sophisticated compliance monitoring and reporting capabilities enable more effective relationships with regulatory authorities by demonstrating proactive risk management, comprehensive oversight, and continuous improvement efforts. These positive regulatory relationships can provide significant value during examinations, enforcement actions, or policy development processes.

The data and insights generated by AI analysis also support more informed participation in regulatory policy development, industry working groups, and compliance best practice initiatives that can influence regulatory evolution and improve industry-wide compliance effectiveness. This thought leadership positioning can provide strategic advantages and industry recognition that benefits both compliance officers and their organizations.