AI-Powered Risk Analysis & Scoring

Transform your contract evaluation process with intelligent risk assessment that identifies, quantifies, and prioritizes contractual risks before they become costly problems.

Revolutionary Risk Intelligence for Modern Contracts

In an increasingly complex business landscape, contractual risk assessment has evolved from a reactive compliance exercise to a proactive strategic imperative. Traditional manual risk analysis methods, which rely heavily on individual expertise and experience, often fall short in today's high-volume, fast-paced business environment. The consequences of overlooking critical risks can be severe, ranging from financial losses and regulatory penalties to reputational damage and operational disruptions.

AI-powered risk analysis and scoring represents a fundamental transformation in how organizations approach contract evaluation. By leveraging advanced machine learning algorithms, natural language processing, and extensive legal databases, this technology provides comprehensive, consistent, and actionable risk intelligence that empowers legal professionals and business stakeholders to make informed decisions with confidence.

The sophistication of modern AI risk analysis goes far beyond simple keyword detection or basic pattern recognition. These systems employ deep learning models trained on millions of contracts, legal precedents, and regulatory requirements to understand not just what risks exist, but how they interact, compound, and potentially manifest in real-world scenarios.

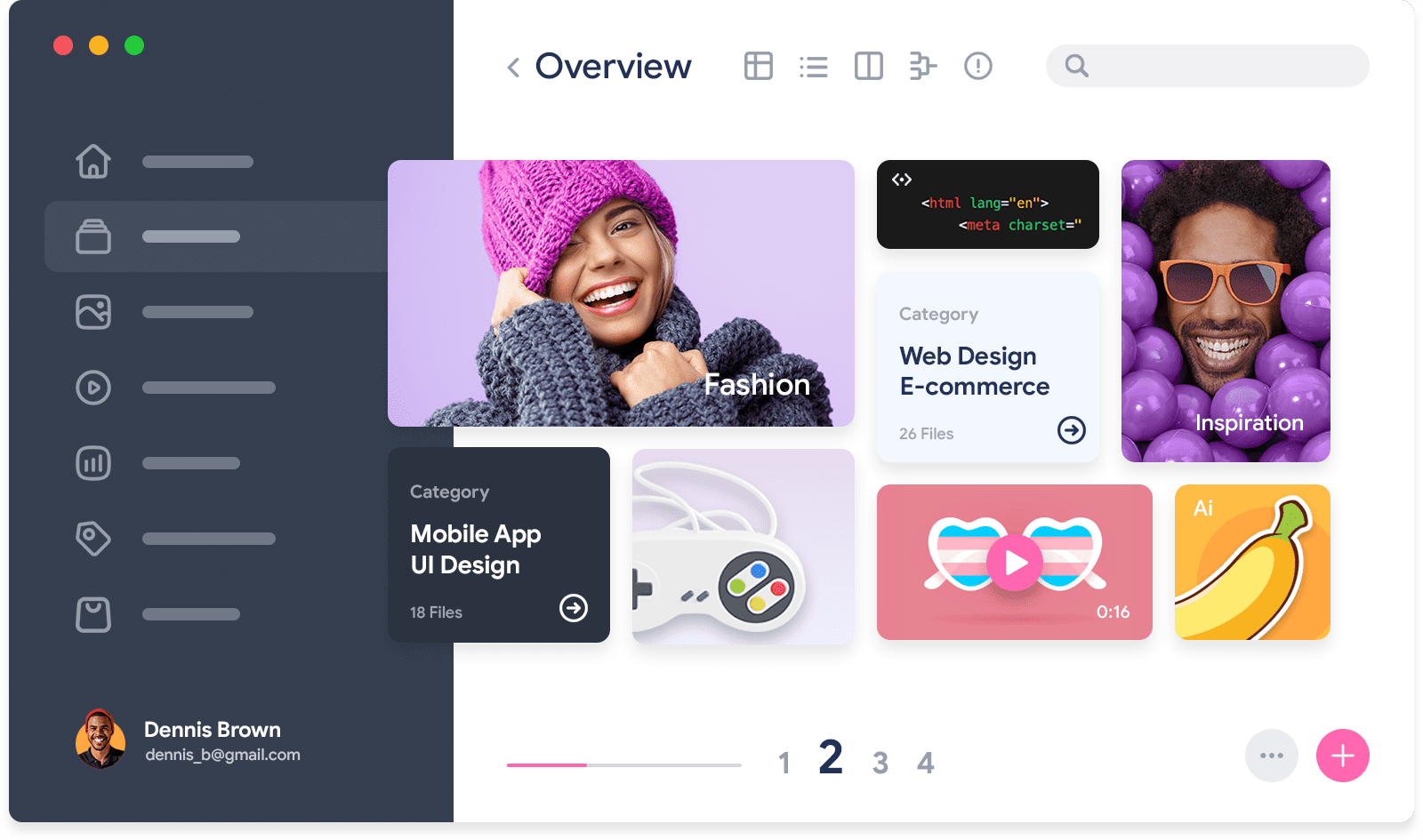

Visual Risk Heatmaps: Instant Risk Comprehension

Risk heatmaps represent one of the most powerful innovations in contract risk visualization. These sophisticated visual tools transform complex risk assessments into intuitive, color-coded displays that enable immediate comprehension of a contract's risk profile. Unlike traditional text-heavy risk reports that can overwhelm reviewers with information, heatmaps provide instant visual clarity about where attention should be focused.

Color-Coded Risk Stratification

The color-coding system employed by advanced risk heatmaps follows established conventions that legal professionals can quickly understand and act upon. Red zones indicate high-risk clauses that require immediate attention and likely negotiation, amber sections highlight moderate risks that should be carefully considered and potentially modified, while green areas represent standard or low-risk provisions that align with accepted market practices.

This visual stratification enables rapid triage of contract review efforts. Senior legal professionals can immediately identify which sections require their expertise, while junior team members can focus on reviewing and understanding the lower-risk provisions. This efficient allocation of resources dramatically improves both the speed and quality of contract analysis.

Dynamic Risk Mapping

Modern risk heatmaps are not static displays but dynamic tools that update in real-time as contract terms change or new risk intelligence becomes available. When a clause is modified during negotiations, the heatmap instantly recalculates and updates the risk assessment, ensuring that reviewers always have current, accurate information about the contract's risk profile.

The dynamic nature of these tools extends to their ability to incorporate external factors that might affect risk calculations. Changes in regulatory requirements, industry standards, or company policies can trigger automatic updates to risk assessments, ensuring that evaluations remain current and relevant.

Granular Risk Detail

While heatmaps provide excellent high-level overviews, they also support drill-down functionality that reveals detailed risk analysis at the clause level. Users can click on any colored section to access comprehensive explanations of identified risks, potential consequences, and recommended mitigation strategies. This combination of visual overview and detailed analysis provides the perfect balance of accessibility and depth.

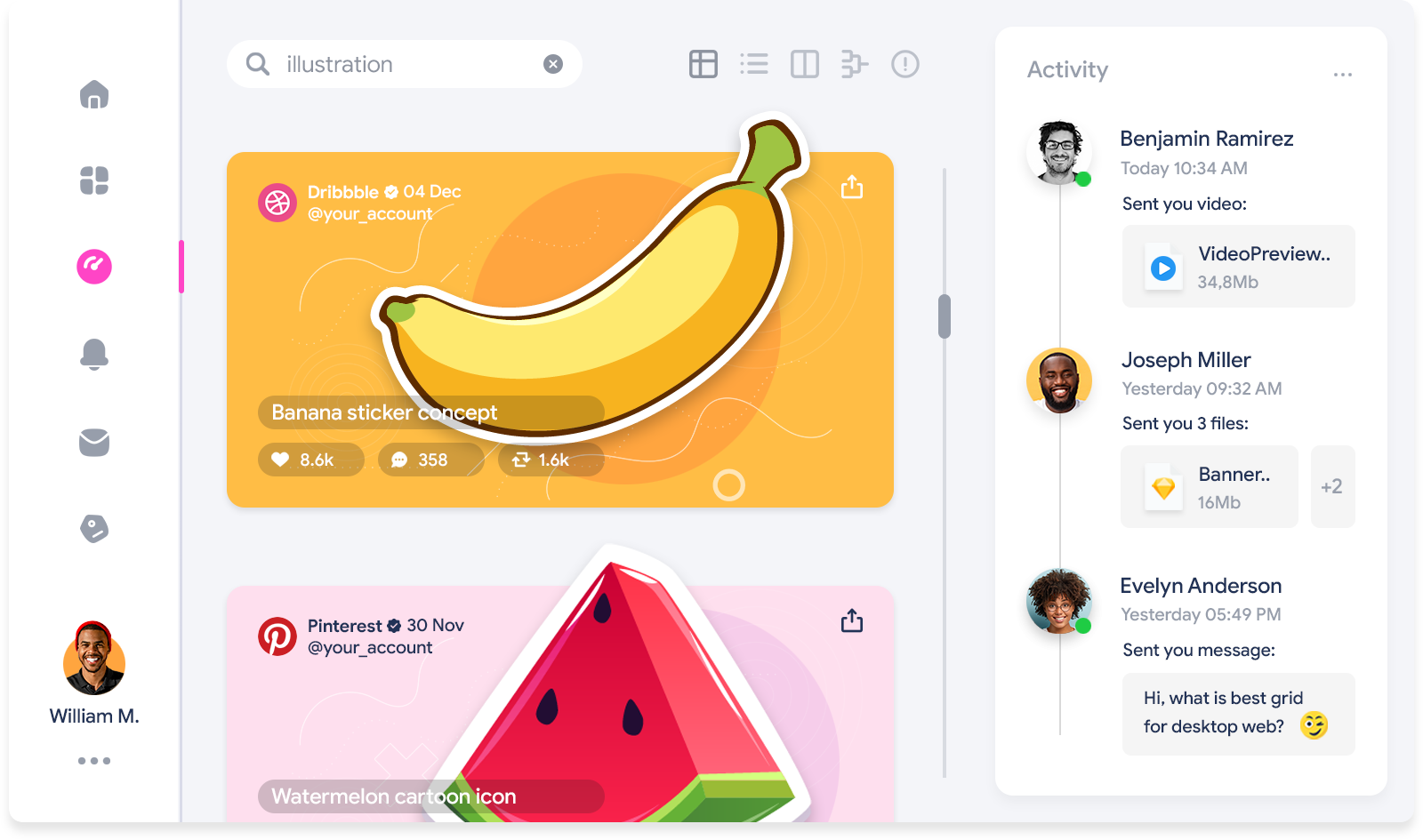

Intelligent Risk Detection and Flagging

The power of AI-driven risk analysis lies not just in its ability to process large volumes of text quickly, but in its sophisticated understanding of legal language, contractual relationships, and potential consequences. Advanced risk flagging systems go far beyond simple keyword searches to provide contextual, nuanced analysis of contractual provisions.

Comprehensive Risk Categories

Modern AI systems can identify and categorize dozens of different risk types, each with its own specific characteristics and potential consequences. Financial risks include unlimited liability clauses, inadequate insurance requirements, and payment terms that could create cash flow issues. Operational risks encompass service level agreements that may be difficult to meet, termination clauses that could disrupt business continuity, and intellectual property provisions that might limit future business opportunities.

Legal and regulatory risks represent another critical category, including compliance requirements that may be difficult to satisfy, jurisdiction and governing law clauses that could create litigation disadvantages, and indemnification provisions that might expose the organization to unexpected liabilities. The AI system's ability to recognize and categorize these diverse risk types ensures comprehensive coverage that human reviewers might miss under time pressure.

Context-Aware Risk Assessment

Perhaps the most sophisticated aspect of modern risk flagging is its context-aware analysis capability. The same contractual provision might represent different levels of risk depending on factors such as the counterparty's jurisdiction, industry sector, financial stability, and the overall contract structure. AI systems consider these contextual factors when calculating risk scores and generating recommendations.

For example, a standard limitation of liability clause might be flagged as low risk in a routine service agreement with an established vendor, but the same clause could trigger a high-risk warning in a contract with a startup company or in an agreement involving critical business operations. This contextual sensitivity ensures that risk assessments are not only accurate but also practically relevant.

Predictive Risk Modeling

Advanced AI systems don't just identify current risks; they also employ predictive modeling to anticipate potential future issues. By analyzing historical contract performance, litigation trends, and regulatory developments, these systems can flag provisions that might become problematic under changing circumstances. This forward-looking approach enables proactive risk management rather than reactive problem-solving.

Customizable Risk Playbooks and Standards

While industry standards and best practices provide valuable baselines for risk assessment, every organization has unique risk tolerances, business models, and strategic priorities. Customizable risk playbooks enable organizations to tailor AI-powered risk analysis to their specific needs, ensuring that risk assessments align with corporate policies and strategic objectives.

Organization-Specific Risk Frameworks

Customizable playbooks allow organizations to define their own risk hierarchies, acceptable terms, and red-line provisions. A technology startup might be comfortable with certain intellectual property licensing arrangements that would be unacceptable to an established pharmaceutical company. A multinational corporation might have different risk tolerances for different geographic regions or business units.

These customized frameworks ensure that AI risk analysis reflects the organization's actual risk appetite rather than generic industry standards. The result is risk assessments that are not only accurate but also actionable and relevant to the specific business context.

Policy Integration and Compliance

Custom playbooks enable seamless integration with existing corporate policies, compliance requirements, and governance frameworks. Organizations can configure AI systems to automatically check contracts against internal approval authorities, spending limits, vendor qualification requirements, and other policy considerations.

This integration ensures that risk analysis encompasses not only legal and business risks but also compliance and governance considerations. Contracts can be automatically flagged when they deviate from established policies, require specific approvals, or need additional review by subject matter experts.

Continuous Learning and Adaptation

The most sophisticated custom playbooks incorporate machine learning capabilities that enable continuous refinement based on organizational feedback and outcomes. When legal professionals provide feedback on risk assessments, approve certain terms, or negotiate specific modifications, the AI system learns from these decisions and gradually improves its risk calculations for future contracts.

Comprehensive Contract Risk Scoring

Quantitative Risk Assessment

Overall contract risk scoring represents the culmination of sophisticated AI analysis, distilling complex risk assessments into simple, quantitative measures that enable rapid decision-making and prioritization. These numerical scores provide objective, consistent baselines for comparing different contracts, versions, and negotiation alternatives.

The scoring methodology typically employs weighted algorithms that consider not just the number and severity of individual risks, but also their interdependencies and cumulative effects. A contract might contain several moderate risks that, when combined, create a high-risk scenario that requires senior attention. Advanced scoring systems recognize and account for these complex risk interactions.

Decision Support and Escalation

Risk scores serve as powerful decision support tools that help organizations establish consistent contract review and approval processes. Companies can establish score-based escalation procedures: contracts scoring below a certain threshold might be approved by junior legal staff, while higher-risk agreements require senior legal review or executive approval.

These objective scoring criteria eliminate guesswork and subjective judgment from escalation decisions, ensuring that appropriate resources are allocated to review contracts based on their actual risk profiles rather than other factors such as deal size or counterparty prestige.

Portfolio Risk Management

Beyond individual contract assessment, risk scoring enables sophisticated portfolio-level risk management. Organizations can analyze risk distributions across their entire contract portfolio, identify concentration risks, and track risk trends over time. This portfolio perspective provides valuable insights for strategic planning, resource allocation, and risk management strategy development.

Implementation Strategy and Return on Investment

Measurable Business Impact

Organizations implementing AI-powered risk analysis typically see significant measurable improvements in contract management efficiency and effectiveness. Review times are reduced by 70-80%, while risk detection accuracy improves dramatically compared to manual processes. More importantly, organizations report fewer post-signature disputes, reduced litigation exposure, and better negotiation outcomes.

The financial impact extends beyond efficiency gains to include real risk mitigation value. By identifying and addressing risks during negotiation rather than after contract execution, organizations avoid costly disputes, performance failures, and compliance issues that might otherwise go undetected until they become expensive problems.

Change Management and Adoption

Successful implementation of AI-powered risk analysis requires thoughtful change management that addresses both technical and cultural considerations. Legal professionals need training not only on how to use the new tools but also on how to interpret AI-generated insights and integrate them into existing workflows and decision-making processes.

The most successful implementations involve gradual rollouts that allow teams to build confidence and competency with AI tools while maintaining existing quality standards. Organizations that invest in comprehensive training and change management typically see much faster adoption and better outcomes than those that treat AI implementation as purely a technology deployment.